Navigating the world of taxes can be daunting, but choosing the right tax software such as TurboTax alternatives can help you a lot.

If you’re looking for alternatives to TurboTax, the market offers plenty of options that cater to various needs and preferences.

These options vary in features, pricing, and user-friendliness.

This ensures that whether you’re a seasoned tax filer or new to the game, there’s a solution that fits your situation.

While TurboTax is a well-known name with a strong reputation, it’s not the only player in the field.

Alternatives like H&R Block, TaxAct, TaxSlayer, FreeTaxUSA, and even newcomer Cash App Taxes offer competitive services that might align more closely with your requirements.

Each software presents its own mix of advantages from affordability to user experience, and it’s worth taking a closer look to understand how they can simplify your tax filing process.

Some of these platforms offer free versions for basic tax returns, while others might be a better fit if you’re dealing with more complex tax situations, such as freelancing, investments, or owning a business.

Factors such as the availability of professional support, ease of use, and the cost of added services are important considerations as you decide which alternative to choose.

Remember, the goal is to find a tax software that provides the support you need to file confidently and accurately, possibly saving you time and money along the way.

Free TurboTax Alternatives

When it comes to filing your taxes without the hefty price tag, you have several reputable free options to choose from.

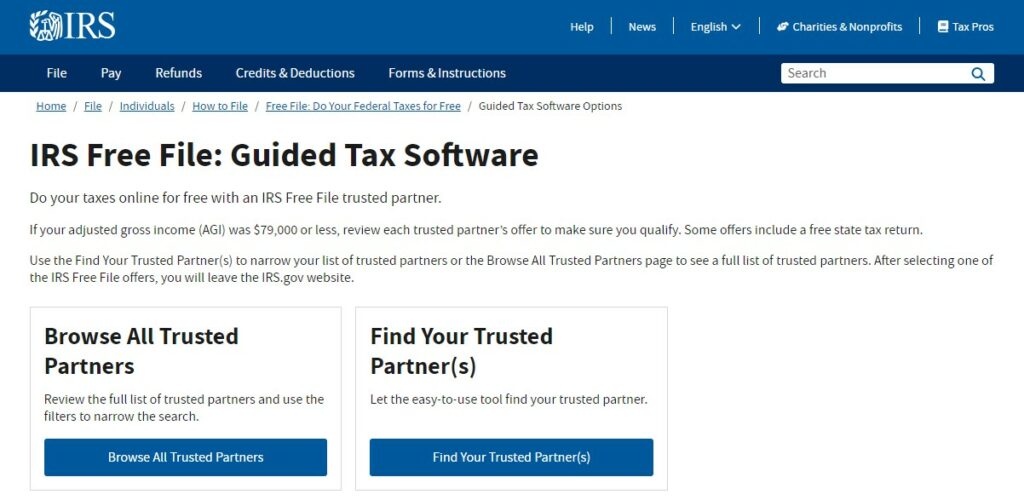

1. IRS Free File Program

If your adjusted gross income is $73,000 or less, you’re eligible for the IRS Free File Program.

This program partners with several tax software companies to provide free federal tax filing services.

In addition to federal filings, some vendors in the Free File program also offer free state returns.

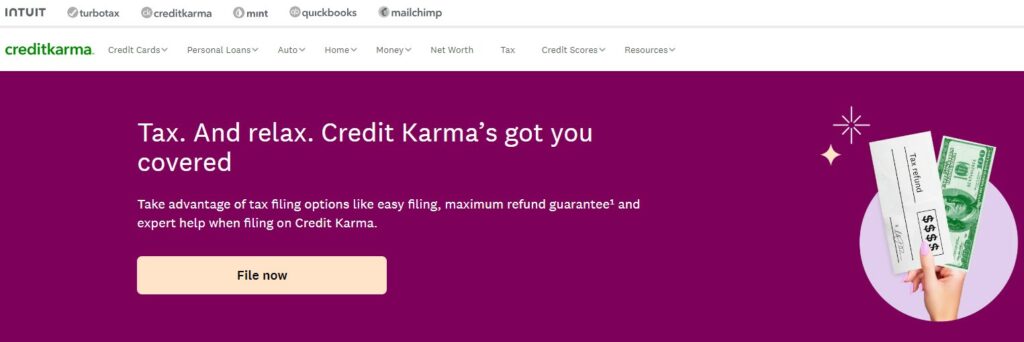

2. Credit Karma Tax

Credit Karma Tax is a completely free tax service that includes federal and state e-filing.

It supports a variety of IRS forms and schedules, making it a suitable option for more complex tax situations.

Moreover, there’s no income limit, so it’s accessible to a broader range of taxpayers.

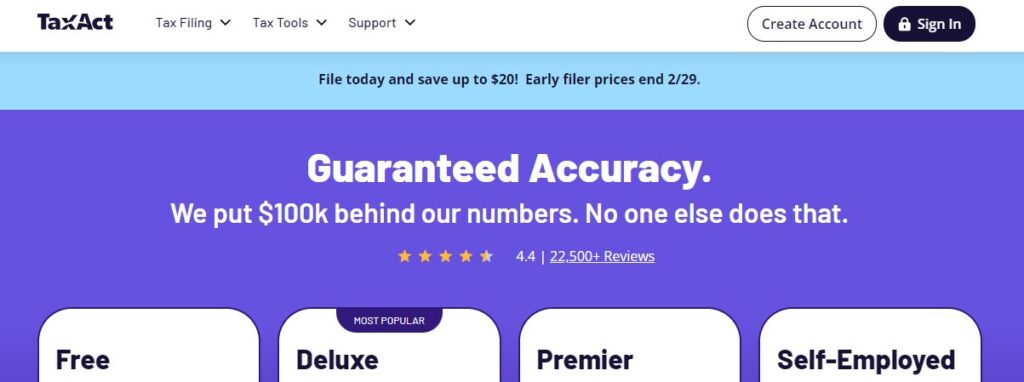

3. TaxAct Express

Another alternative is TaxAct Express.

For simple tax situations, TaxAct offers a free version that covers federal filing.

However, please note that there might be a fee for state returns.

TaxAct’s free version also includes tax support from specialists, which can provide an added layer of assurance as you file.

Paid TurboTax Alternatives

When you’re looking for a comprehensive tax filing solution, there are several paid alternatives to TurboTax that could suit your needs.

Each platform comes with its own set of features, pricing, and support to help you through the tax season.

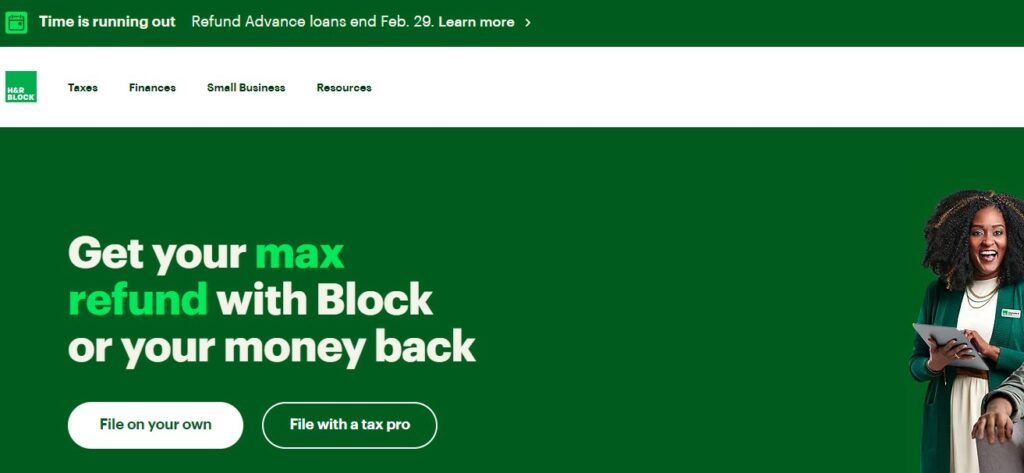

4. H&R Block

H&R Block offers you a familiar and reliable tax preparation experience with physical branches across the country.

If you prefer software assistance with the possibility of in-person help, this could be your go-to service.

Their software is known for a user-friendly interface and straightforward guidance.

5. TaxSlayer

TaxSlayer provides you with various tiers of tax preparation services, including a self-employed option ideal if you’re managing your own business finances.

They are celebrated for offering substantial tax support at a competitive price.

6. eSmart Tax

eSmart Tax, backed by Liberty Tax Service, aims to give you a smart, secure filing option with a satisfaction guarantee.

They offer a variety of support options, including chat and email support to assist you during your tax preparation process.

Features to Consider

When scouting for TurboTax alternatives, you’ll want to evaluate the features that can impact your tax filing experience.

Focus on these three key areas to make the best choice for your needs.

Price

The cost of tax software varies, and it’s crucial to find an option that fits within your budget.

Free versions may be available for simple tax situations, while paid versions can range from around $49 to $119 or more, depending on the complexity of your taxes and the level of service you require.

Always check if the listed pricing is for online filing and includes your filing type, such as personal or self-employed taxes.

Ease of Use

Your time is valuable, so a straightforward and user-friendly interface is essential.

Tax software should guide you step by step through the filing process.

Look for features like easy import of previous tax returns, clear instructions for deductions and credits, and an intuitive design.

A user-friendly software can minimize errors and make the task less daunting.

Support

Robust support ensures peace of mind during tax season.

Verify that your chosen software provides access to tax professionals, comprehensive FAQs, or audit support guarantees.

Some platforms may offer live chat, phone support, or forums where you can seek guidance.

When tax rules leave you puzzled, having reliable support can be a real lifesaver.

Key Takeaways

When exploring tax software alternatives to TurboTax, here’s what you need to keep in mind:

- Variety of Options: You have multiple alternatives.

- Each caters to different needs such as personal and self-employed tax filings.

- Free Alternatives: The IRS is launching a free software, Direct File.

- It’s available in some states and could be a cost-effective option.

Pricing:

- TurboTax alternatives come with various pricing models.

- Make sure to compare these to find one that aligns with your budget.

Features to Consider:

- Some alternatives offer specific benefits for certain groups.

- For example, TaxSlayer provides advantages for active-duty military.

- Check for the latest updates on features and pricing.

- This information can change yearly.

User-Friendly:

- Look for software that simplifies the filing process.

- It should offer a clear and straightforward user experience.

Support and Resources:

- Ensure that the tax software you choose has strong customer support and educational resources.

- These will assist you during the tax filing process.